Defining DePin’s Supply and Demand Challenges

In the DePin sector, the primary barrier to entry and maintenance is high, according to PINGPONG, a DePinFi money market. Establishing mining nodes requires advanced technical skills and high-end hardware for DePin network mining.

It involves manual integration of nodes or networks, constant updates, and complex configurations. As a result, DePin mining remains a domain for expert miners, leaving average enthusiasts out.

Furthermore, mining rewards do not motivate a broader audience to participate. The limited availability of DePin networks leads to underutilization of computing resources. DePin mining rewards are too low for individuals to devote their machines extensively to it.

Decentralized Physical Infrastructure Network (DePIN) Projects to Watch in 2024

On the demand side, developers have a fragmented development experience. The DePin network offers different services necessary throughout an application’s lifecycle, written and packaged with a variety of tech stacks.

This means developers have to deal with multiple client connections. Using this setup increases infrastructure costs and development time.

There is also a lack of compute resource depth and an unpredictable uptime with DePin networks. Combined with geolocation-based latency and volatile token prices, these challenges make it difficult to deliver stable, efficient applications. As a result, potential users are deterred from adopting and using DePin-based services.

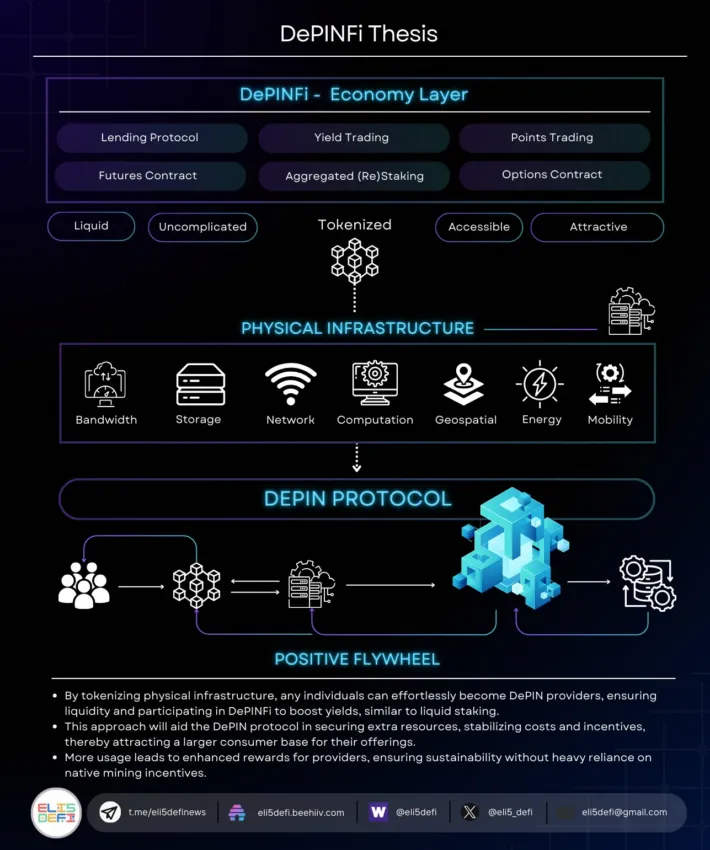

DePin projects are focused on building in the real world – they might overlook onchain liquidity. That’s what DeFi for DePIN protocols are for.

Could DePinFi be a promising solution?

According to Eli5DeFi, an eminent Web3 analyst, DePinFi provides a compelling solution for these problems. Tokenizing physical infrastructure enables DePinFi to make its services accessible to anyone, ensuring liquidity and enhancing participation in DePinFi to boost yields.

Eli5DeFi compared DePinFi to Lido for DePin projects in an interview with BeInCrypto. To explain the use cases of DePinFi, he cited examples such as io.net and Aethir.

As a result, additional resources are secured, costs are stabilized, and incentives become more attractive and sustainable. In turn, consumers are more likely to use DePin offerings, which results in higher rewards for providers. Thus, it ensures sustainability without heavily relying on native mining incentives.

Additionally, io.net teased that it was building an emerging DePinFi ecosystem around its services. Also, DePin company IoTeX supports the combining of DePin and DeFi.

“DePin projects are focused on building in the real world – they might overlook onchain liquidity. That’s what DeFi for DePIN protocols are for,” said IoTeX.

It is expected that DePinFi will become the next big narrative in the months to come as it gains traction. Decentralized networks are only at the beginning of their journey as the nascent DeFi ecosystem is being developed on platforms like io.net.

Disclaimer: This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

TAGS IN THIS STORY

Image Credits: Shutterstock, Pix, Finbold

🤟🏼 Helpful Crypto, blockchain and web3 links

Interested in a crypto job? Looking to hire crypto, blockchain or web3 talent? Search other crypto jobs, our services and follow RecruitBlock on LinkedIn or blog.

Want to learn more about what’s happening in the crypto industry? Here are some great places to start! Cointime Coindesk Cointelegraph CoinMarketcap or get involved in the decentralised community and blockchain in London – CryptoMondays House of Block